Domestic tractor market to see modest growth of 3-5% in next fiscal: CRISIL

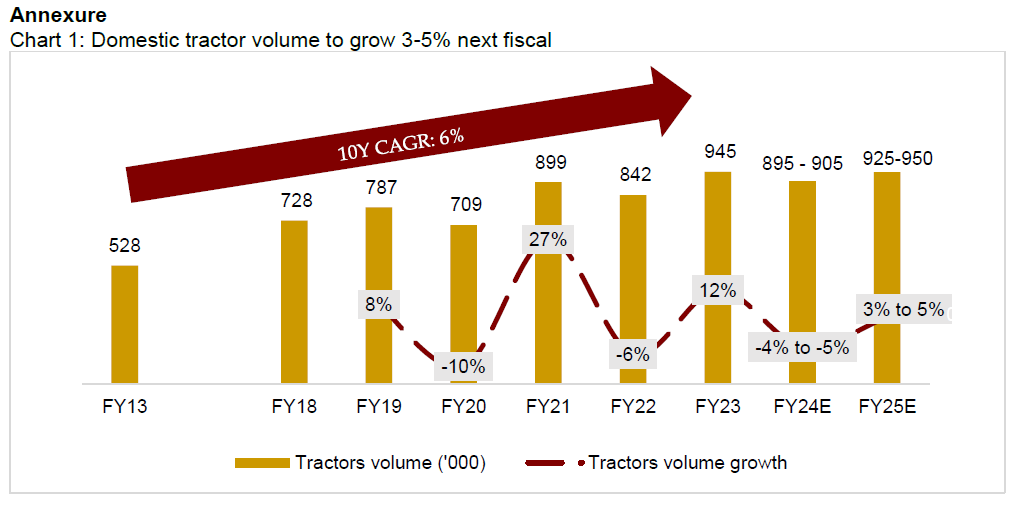

28 February 2024, New Delhi: After a decline of 4-5% in the current fiscal, domestic tractor volume will recover to clock a modest growth of 3-5% in fiscal 2025, driven by expectation of a normal monsoon supporting rural sentiment, higher farm income and good replacement demand.

Operating margin will remain healthy at 15-16%, aided by range-bound raw material prices. Moreover, net cash-positive balance sheets will continue to support strong credit profiles.

A CRISIL Ratings analysis of five tractor makers (includes Mahindra and Mahindra Ltd, Escorts Kubota Ltd, Tractors and Farm Equipment, TAFE Motors and Tractors, and International Tractors Ltd.), which comprise 80-85% of the sectoral revenue, indicates as much.

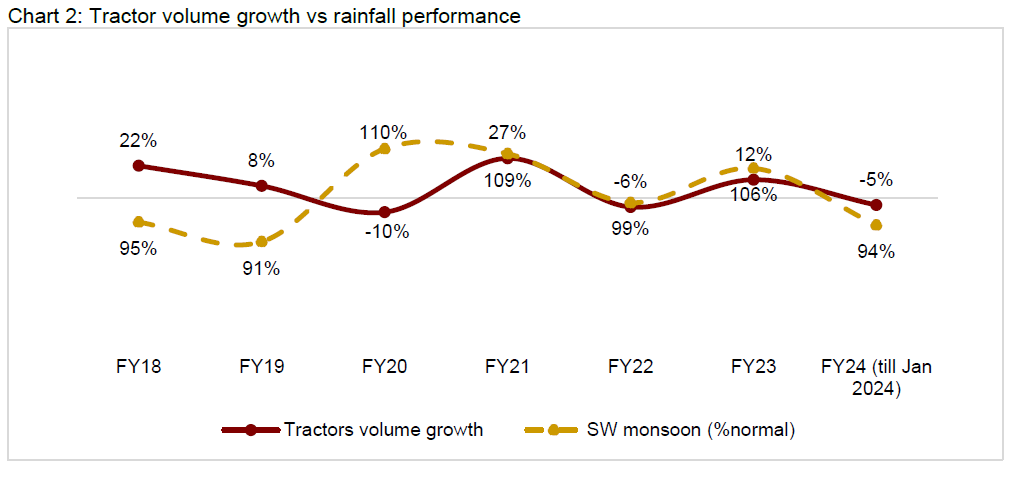

Agriculture accounts for about three-fourths of tractor demand and is led by farmer sentiment, which is primarily influenced by monsoon and rural income. The remaining demand comes from commercial segments such as infrastructure and mining.

Successive years of normal monsoon over fiscals 2021-23 have led to positive rural income, resulting in a compound annual growth rate (CAGR) of 10% in tractor sales against the long-term average growth rate of 6% in the past decade. Tractor sales peaked at ~945,300 units in fiscal 2023 (refer to chart 1 in annexure).

The decline this fiscal and the modest growth next fiscal is majorly on account of the high base effect.

This fiscal was also impacted by an uneven monsoon caused by the El Nino impact. Spatially ill-distributed monsoon marred Kharif crop production in fiscal 2024, especially in the southern states where tractor volumes declined around 20% this fiscal. Moreover, reservoir levels were 18% lower than last year and 5% below the decadal average (According to the Central Water Commission’s report on 150 important reservoirs)

Naveen Vaidyanathan, Director, CRISIL Ratings says, “Weather bureaus have come out with a forecast of a normal monsoon (preliminary forecast) for the coming season, which augurs well for rural sentiment. Moreover, the minimum support price (MSP) for wheat, the primary rabi crop, has been increased by 7% for the 2024-25 marketing season. Demand next fiscal will also be supported by healthy replacement demand.”

Tractors typically have a lifecycle of 6-8 years and replacement demand accounts for 60-65% of volume. Tractor volume saw healthy growth between fiscal 2016 and 2018, which can translate into replacement volume next fiscal. Demand will also continue to be supported by infrastructure and construction activity, with sustained government emphasis on infrastructure spending in the interim budget.

Nitin Bansal, Associate Director, CRISIL Ratings, “The volume rebound will be accompanied by stable operating margins of 15-16% for tractor manufacturers as prices of steel and pig iron, which account for ~90% of total raw material cost, are expected to be largely stable. Operating margins have improved by 100-200 basis points this fiscal as input prices softened.”

Credit profiles, too, will remain healthy, with negligible debt for most players, besides comfortable cash surplus and limited capital expenditure requirement given the capacity utilization of 75-80%.

That said, how the monsoon eventually plays out in terms of rainfall and spatial distribution and what impact it has on demand will bear watching.

Also Read: Marut Drones and PJTSAU’s Direct Seeding Device Receives World’s First Utility Patent

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)