Proposal for Agri Income Slabs: Parliamentary Panel Calls for Tax Code Differentiation

01 March 2024, New Delhi: A recent report from a Parliamentary panel has urged the finance ministry to explore the implementation of distinct tax codes for different slabs of agricultural income. The proposal aims to differentiate between farmers with solely agricultural income and those with both farming and non-farming income, for tax purposes.

The panel emphasizes the need for a separate tax code specifically designed for farmers with only agricultural income, whose earnings fall below the exemption limit. Such a code would serve the purpose of creating a clear distinction, enabling the identification of potential instances of tax avoidance and money laundering through agricultural activities, as stated in the Public Accounts Committee (PAC) report.

Agriculturists, comprising approximately 140 million families, form a heterogeneous group ranging from small and marginal farmers to corporate entities. Around 80% of these farmers belong to the small and marginal categories.

The proposed tax code would aid in segregating cases involving income solely from agricultural sources from other cases, facilitating better targeting and scrutiny. In the assessment year 2020-2021, the finance ministry informed the panel that out of 2.1 crore individuals reporting agricultural income in their returns, around 59,707 declared income exceeding ₹10 lakhs. The ministry took up 3,379 cases for verification, including those with agricultural income below ₹10 lakhs.

The panel suggests that the Central Board of Direct Taxes (CBDT) should focus on individuals reporting higher agricultural income, particularly those falling into three income slabs above ₹10 lakhs. The ministry should consider implementing a mechanism for categorizing cases based on agricultural income, specifically targeting high-risk cases falling within the slabs of above ₹10 lakhs, ₹50 lakhs, and ₹1 crore, utilizing computer-based scrutiny.

Such a measure would not only facilitate scrutiny of different types of agriculturists, considering the limited resources available to the ministry, but also help prevent potential revenue leakage, as highlighted in the report.

To ensure the accuracy of agricultural income claimed for exemption, the report recommends providing tax officers with standardized operating procedures.

The implementation of differentiated tax codes for agricultural income slabs would bring about greater transparency, effective scrutiny, and improved revenue collection. It would enable the government to better regulate tax compliance within the agricultural sector while providing targeted support to small and marginal farmers.

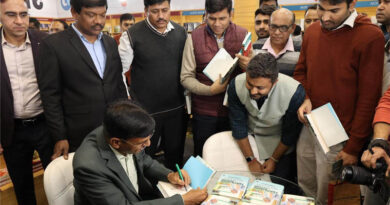

Also Read: Secretary Agriculture Releases Two Whitepapers by Kisan-Vigyan Foundation on India’s Food Security

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)