Sheep price autumn forecast with Simon Quilty

01 March 2024, AU: In general, we have seen some firming in lamb and mutton prices to start 2024.

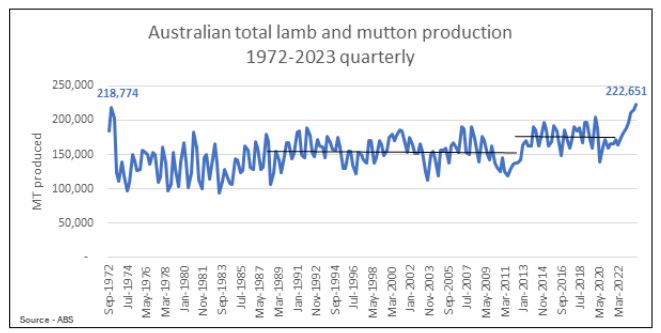

As the months pass, the Australian sheep flock continues to liquidate with the mutton kill (which reflects the female kill) sitting at a 10-year high. Whilst we saw some price increases in key regions to start the year, production has reached record levels, with some oversupply resulting in poorer pricing.

When the sheep and lamb kills were combined in Q4 of 2023, it totalled a record 222,651 megaton (MT). This is not on the back of a large flock, but related to the highly efficient production of lambs.

Unlike beef, the price lift in lamb to start 2024 might be short-lived due to the ability to ramp production up quickly when the right price signals appear.

The sector may encounter issues due to the lack of workforce capacity in processing to handle the increased slaughter number of close to 8 million head.

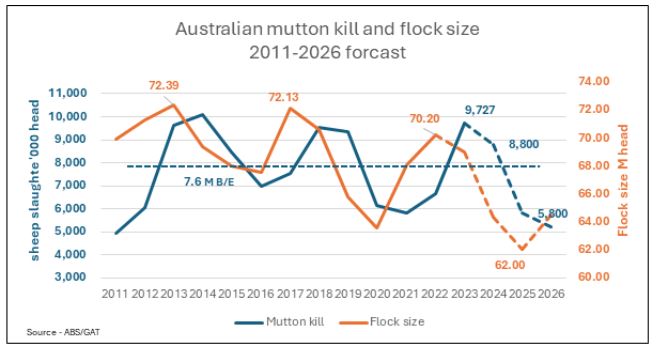

The long-term break even on mutton kill is 7.6 million head, and in 2023 more than 9.7 million sheep were slaughtered; the expectation is that this year will continue to see a large sheep kill, at close to 8.8 million head as the flock continues to liquidate.

It should be noted that the mutton kill is made up of ewes with hardly any wethers being retained. Hence, a heavy mutton kill reflects a heavy female sheep kill and liquidation, and a low mutton kill reflects ewe retention and a rebuilding process.

When assessing on a state-by-state basis, NSW has had the longest and heaviest liquidation period over seven months compared to 5 months in both Victoria and SA; there has been no liquidation so far in SA.

Further liquidation is expected for most of this year, with a strong flock rebuild expected to commence in 2025.

Also Read: Secretary Agriculture Releases Two Whitepapers by Kisan-Vigyan Foundation on India’s Food Security

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)