Pesticide Registration in Brazil

Guest Author: Flávio Hirata, agronomist (ESALQ-USP) and an expert in pesticide registration and partner at AllierBrasil. E-mail: flavio.hirata@uol.com.br (The article was originally published in Global Agriculture)

11 January 2024, Brazil: Brazilian agriculture is the most important in the world. Brazil is ranked # 1 in the production of soybean, coffee, and sugarcane, # 2 in citrus, # 3 in corn, and # 4 in cotton, representing 300 million tonnes of grains, in a total area of 77 million hectares. In 2022, exports of agricultural products reached US$ 159 billion, agriculture represented 24.8% of the national GDP, 47.6% of Brazilian exports, and was responsible for 21% of regular employment.

For this, modern technologies, such as pesticides, are important tools. The Brazilian pesticide market is the most attractive in the world, totaling US$ 20.5 billion in 2022, an increase of 36.5% compared to 2021. Five to six players have more than 70% of the market share, and none of these companies are Brazilian-owned.

The first step to access the most attractive market in the world is product registration. For more than 40 years, pesticide registration has been a bottleneck, and time for registration can take more than 10 years, considering both technical and chemical-formulated products.

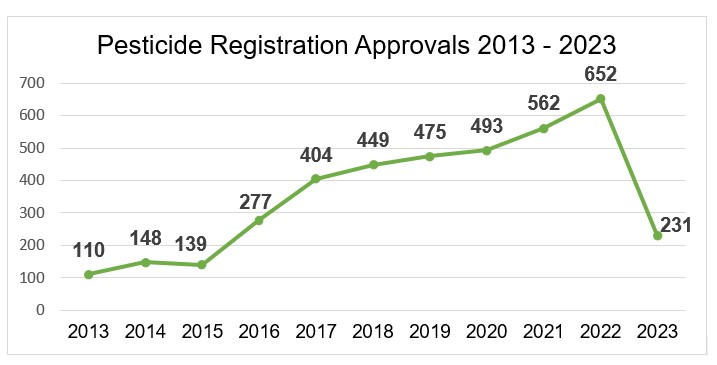

On the other hand, since 2017, regulatory agencies increased considerably the number of registration approvals. Even so, the submissions of the chemical formulated products that were last approved were applied in 2016 and 2017. This means that the time for approval of a chemical formulated product takes six to seven years, and this comes only after the approval of the technical product because the formulated product is only eligible for evaluation after its technical product is approved.

Source: Ministry of Agriculture, adapted by AllierBrasil.

In 2002 when Presidential Decree No. 4074 authorized registration based on equivalency, new players foresaw the chance to access the generic pesticide market at lower registration costs. However, only by 2004-2005 the regulatory agencies started evaluating ‘meto’ registrations on a regular basis. After that, until 2007-2008 the approval of technical products used to take six to eight months, and the approval of formulated products used to take an additional two to four months. Two companies stood out in this race, Volcano and Consagro, the last one a subsidiary of FMC, with registrations assisted by AllierBrasil. Both companies got approvals of more than 120 registrations in this short period of time. Some other companies started at the same time, however, without the right expertise, they failed in their first try and had to reinitiate submissions all over again, wasting a huge amount of resources and, most importantly, time.

Meanwhile, by 2006-2008 local and international generic pesticide companies noticed the possibility of accessing this tremendous market and initiated the process of sourcing from China. This, together with AllierBrasil’s efforts to show foreign players the attractiveness of the Brazilian market, was the trigger for them to decide to start registration in Brazil.

However, registration costs were a big barrier for entrants. The cost of US$ 80,000 for a technical product GLP dossier and US$ 75,000 for a formulated product, totaling almost US$ 160,000, still prevented access. At that time, different from what used to happen in 2004-2007, time for registration approval became longer and longer. For many years there was a gap between registration submission and approval, which started changing after 2017.

From China, companies such as CAC, Yonon, Jiangsu Good-Harvest, Jingma, Luba, Hailir, Hisun, Wynca, Max (Rudong), Ora, and many others, with the support of AllierBrasil, started their own registrations. Some of them shared their dossiers with already established players in order to broaden their distribution system.

In 2016-2017, laboratory costs started dropping considerably, enabling medium and small-size companies to try to have their own registrations. Today a dossier of a technical product costs approximately 40% of what it did 10 years ago. This is also the case for formulated product dossiers.

Since then, there have been several regulation changes, forcing registration applicants to redo laboratory trials, such as five batches, eye irritation, mutagenicity, and eco-tox (algae, earthworm, microcrustaceans, fish, honeybees, avian). Because of these changes, many registration submissions were rejected, with the penalty of rejection of all formulated products related to the technical product, because according to local regulation, when a technical product registration is rejected, all formulated products related to it are also rejected.

Environmental and toxicological revaluations also impact the market and registrations. When paraquat was banned in 2020 because of toxicological issues, the market and the industry were not prepared to face the new situation. The only product that was able to replace it was diquat, but there were not many approved registrations (50% of which were assisted by AllierBrasil) and suppliers were few, with low production capacity. So, the price increased, and several deliveries were canceled because of supply shortage, bringing lots of profits to only a few players and big losses for others. Another revaluation that impacted the market was imidacloprid, which presented a danger to honeybees. During the revaluation, that was concluded in 2022, no formulated product based on imidacloprid could be registered. After 12 years, new registrations were approved with the restriction for foliar application, while the already registered products still kept the recommendation for this type of application.

Epoxiconazole, procymidone, chlorpyrifos, thiophanate-methyl, and chlorothalonil are under toxicological revaluation or will be soon. Thiamethoxam, fipronil, and clothianidin are under environmental revaluation. Besides paraquat, recently carbendazim was also banned because of toxicological issues.

If 10 to 15 years ago, the registration of 2-5 products could be a good strategy for market access, nowadays at least 10-15 molecules should be considered to succeed. This is because there are already many players with 5-10 registrations and, in order to reach the right distribution channels, it is mandatory to offer a broad product portfolio. Some Chinese factories are selling products from third parties, paying a fee to use their registrations of products they [Chinese factories] do not manufacture. Some other manufacturers are registering products sourced from other manufacturers.

Besides the use of third-party registrations, there is another fast alternative, which is to buy a registration, but this is much more expensive. Every week there is a request to AllierBrasil for the purchase of a registration. The most wanted products are prothioconazole, trifloxystrobin, glyphosate, clethodim, and difenoconazole.

All of these show the difficulties and importance of registration. But this is only the first, most difficult, and longest step. Those who succeed will face many other issues, such as sourcing price, credit, purchasing payment term, exchange rate, access to the right distributor, selling price and payment term, collecting, etc.

Also Read: UPL to strengthen fungicide portfolio with acquisition of Corteva’s Mancozeb business

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)