France and Australia compete for Chinese wheat demand

14 October 2023, Australia: Chinese buyers are in the market for French and Australian wheat after already securing at least 2.3 million tonnes for November-February shipment over the past six weeks.

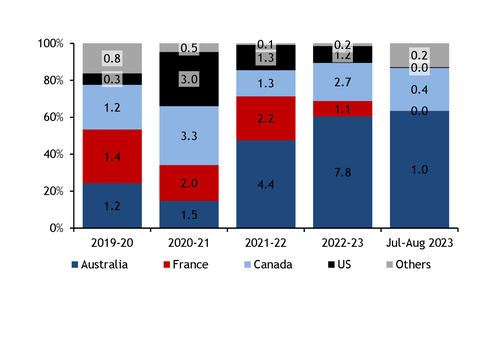

China has bought at least five cargoes of Australian wheat for November-December shipment.

This comes after several rounds of buying since early September, when French wheat dominated the order books. So far, China has bought at least 30 Panamax-sized cargoes of French wheat for December-February loading, importers said, while some French sellers told that the total number could be even higher. The volume is due to arrive in China in 2024, under the quotas for the new calendar year. That said, some of the volumes may not count towards the 2024 wheat import quota.

Importers are continuing to negotiate further purchases, traders said, with both French and Australian wheat in the running.

Australian Premium White (APW) 10.5% protein content was offered around $10/t higher than France’s standard 11% protein content product on a CFR China basis this week, traders said. This compares with a $25/t difference between the two origins some weeks earlier.

Some Chinese millers are ready to pay this difference for APW, given its higher-quality specifications in some areas.

Potential for pressure on Australian prices

Sellers have been actively offering Australia’s new-crop APW wheat, with offer levels for the contract declining slightly over the past few weeks for shipment to southeast Asia. Some pressure on Australian wheat prices may be coming from a halt in the decline of soil moisture levels in Australia in October. Conditions, while significantly worse than a year ago under the La Nina weather pattern, are not near historic lows in New South Wales (NSW) and South Australia (SA), which together account for 55% of Australia’s wheat output.

The two states also have larger high-quality wheat production than Western Australia (WA) because of larger areas of black soil, not present in WA, which produces more of the low protein content wheat.

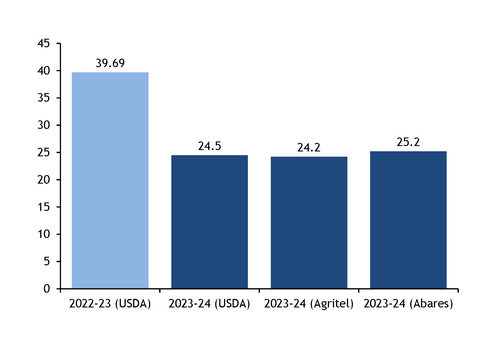

Stable conditions and stable soil moisture in NSW and SA in October may have improved producers’ and exporters’ outlook on production for 2023-24, despite pessimistic forecasts on the back of the El Nino shift (see chart).

Chinese wheat market important for French exporters in 2023-24

As the only major non-EU market where French wheat does not have to compete with Black Sea and other EU wheat, China offers French sellers a key opportunity to ship large volumes of wheat with less pressure from competitors than in other markets.

French sales to China are due to load only from December onwards, but have supported French fob prices in the spot market for October-November.

This could further contribute to France’s slow start to the July 2023-June 2024 marketing year. October-November line-ups at Rouen, La Pallice and Dunkirk remain fairly empty, with more competitive EU and Black Sea sellers taking global market share.

One such market is Morocco, which in 2022-23 took more than half of its wheat imports from France. But Moroccan importers restarted imports from Russia last month, while traders will be most likely to source from Poland and Germany for sales for October shipment made over the past week, market participants said.

Meanwhile, French shipments to Algeria have dropped from over 5mn t/yr to below 2 million tonnes/year on average since the country opened up to Black Sea wheat from 2020-21.

As for Egypt, France has four Panamax-sized vessels due to load at Rouen and Dunkirk for shipment to Egypt in October, the latest line-up data show. Participants in recent GASC tenders ended up sourcing physical volumes from France after they found themselves unable to supply Russian wheat as originally intended under the price agreed. But this too could be short-lived, as Russian wheat came back to the fore in GASC’s latest tender.

Australian competitivity, and the country’s export capacity, could prove to be a key driver for French wheat prices in the second half of France’s 2023-24 marketing year. French exporters’ selling window could be short-lived as competitive Australian new-crop heads ever closer to market.

By Claudia Jackson and Anna Sneidermane

Australia’s wheat production forecasts mn t

China’s wheat imports by origin mn t; %

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)