Chinese pesticide exports decreased 17.54% year-on-year from January to May 2023, industry development staying stable

09 August 2023, China: Over the past two years, the international pesticide market trend has been continually impacted by the complex and ever-changing international situation, as well as the reshaped global energy and supply chain patterns. Since the end of 2022 to 2023, the Chinese pesticide market has been impacted by the macro economy, as well as periodic fluctuations in the pesticide industry and the changes to market supply and demand. It has also suffered from low demand and a sharp decline in the prices of technical materials, resulting in lower trading volumes. Under this situation, the whole pesticide industry has been under ongoing pressure.

The 7th China Pesticide Exporting Workshop (2023 CPEW), hosted by AgroPages and Zhejiang Crop Protection Industry Association, was held as scheduled from July 13 to 14, 2023. Yan Duanxiang, researcher at ICAMA of the Chinese Ministry of Agriculture and Rural Affairs, together with Cao Bingwei, senior agronomist from the International Exchange and Service Department, attended the 2023 CPEW, with each delivering a keynote speech to analyze the status of and trends to the Chinese pesticide export industry. Researcher Yan analyzed the complex environment and challenges faced by pesticide exporters from multiple perspectives, such as from policy, market, and enterprise standpoints, while Cao, an agronomist, analyzed the tendency of Chinese pesticide exporters to utilize the latest pesticide import and export data, to help industry practitioners build confidence and encourage pesticide companies to correctly understand the overall situation faced by the industry during the economic downturn, as well as encourage them to not worry too much.

Pesticide sales dropping but still staying high above the market level before COVID-19

In his presentation, Yan reviewed the history of the development of the Chinese pesticide industry, stating that after years of innovative development, China has become a major international pesticide producer and exporter. Comparing the Chinese pesticide industry in the past two years with the previous decade, it has made significant contributions to global agriculture. Since 2011, China has steadily supplied the world with 100,000 to 1 million tons of pesticides (accounting for more than 67% of China’s output), which are key agricultural tools for production.

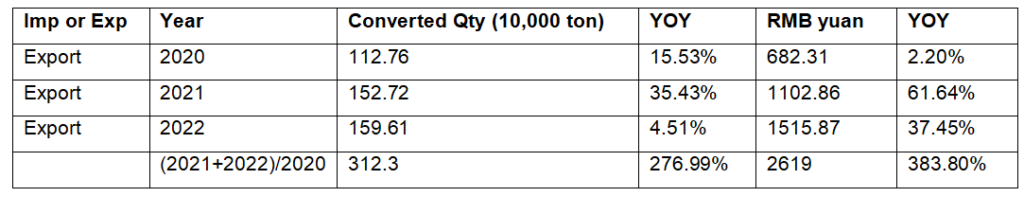

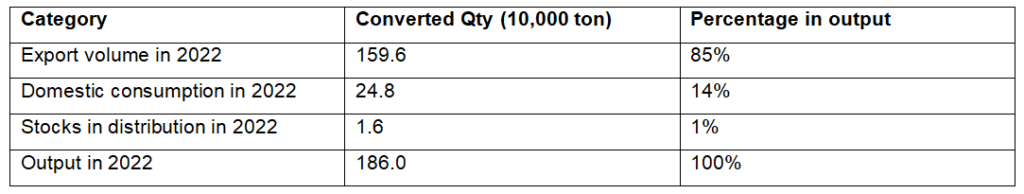

Due to the impact of the COVID-19 pandemic on pesticide production in other countries, China’s supply of pesticides has increased since 2020, with exports exceeding 70% and even approaching or exceeding 85%, therefore, effectively fulfilling global demand.

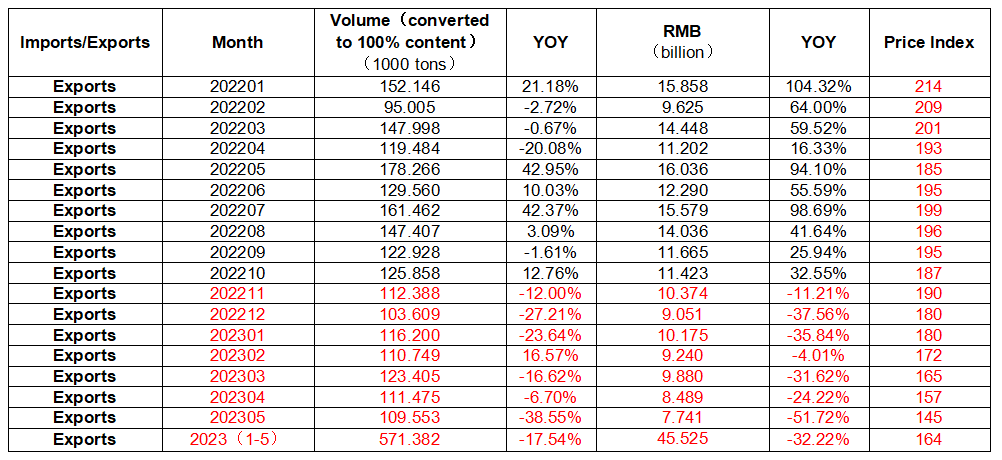

Since the second half of 2022, the related economic operation has witnessed intense pressure, which led to a slow market. However, even though sales have declined, the level has still stayed high and above the market level before COVID-19. Data shows that pesticide sales from January to May 2023 have decreased by 17.5%, while sales revenue decreased by 27.34%, far from returning to normal.

Yan pointed out that pesticides are a necessity that is always needed and can be supplied by China’s stable and advantageous pesticide industry. Currently, manufacturers should refrain from blind production and should stay calm and move forward dedicatedly towards long-term benefits, as this is a highly technical industry.

A 3-year export volume was achieved in 2 years, exports expected to return to normal in second half of 2023

China’s pesticides are mostly made for exports, which accounts for about two-thirds of Chinese pesticide production. The export of pesticides drives the growth of pesticide production. Cao used data collected over the past decade to demonstrate China’s pesticide production and exportation, stating that China’s average pesticide production is 1.48 million tons per year, an increase of 13% while the average total export is 950,000 tons per year, a rise of 35%.

During the COVID-19 pandemic (2020-2022), China’s pesticide export volume reached approximately 3.123 million tons, with a total export value of RMB261.9 billion yuan, of which the proportion of pesticide export in 2022 reached as high as 85% of pesticide production volume that year.

Table 1 Chinese pesticide exports during COVID-19 period (2020-2022)

Table 2 Chinese pesticide exports in 2022

From January to October 2022, the export volume of Chinese pesticides increased, with some months experiencing year-on-year growths of 42.95% and 42.97%. Starting from November 2022, export volume began to decline constantly, with a year-on-year decrease of 38.55% in May 2023, when it reached its lowest point. From January to May 2023, the year-on-year decrease was 17.54%. According to Cao, exports may return to normal from the third quarter of 2023 to 2024.

Table 3 Chinese pesticide exports from Jan 2022 to May 2023

Pesticide export prices yet to return to normal

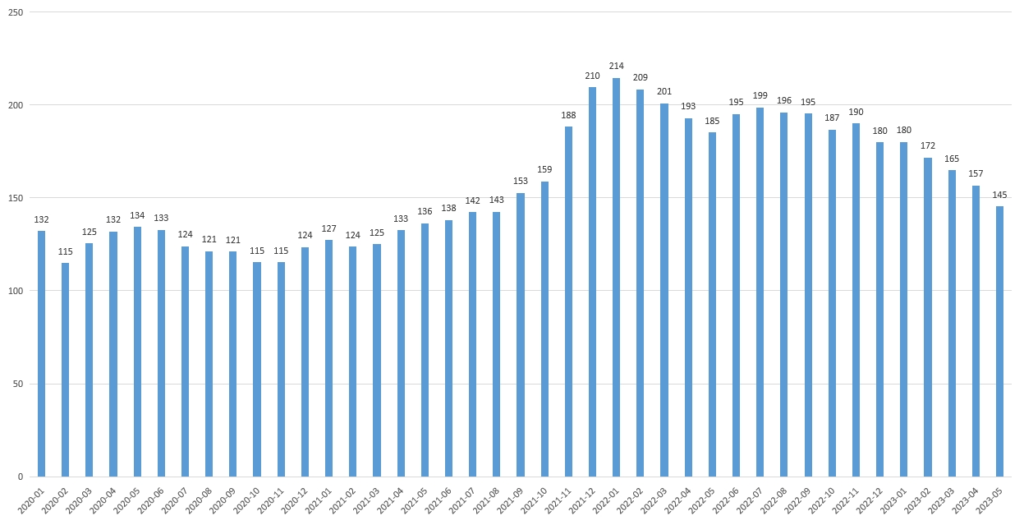

As shown in the pesticide export price indices for the past three years, China’s pesticide export price index continued to rise since 2020 and reached its peak from 2021 to early 2022. Throughout 2022, the pesticide export price index remained relatively high. In addition, from January to May 2023, it decreased by about 30%, which is still far from returning to normal.

Figure 1 Chinese pesticide export price index from Jan 2022 to May 2023

Export-only policy (EX) released, which further regulates and optimizes exports of pesticides

China’s export-only pesticide registration policy has been constantly updated over the past decade. In 2020, the policy was introduced and included in the registration administration system, being categorized as a special type of pesticide registration – export-only registration, with the code, EX.

Over the past two years, over 400 export-only pesticides were granted registration, accounting for 10% of total registrations, which make up a relatively large proportion of China’s pesticide export. All prime pesticide companies have benefited from the export-only policy. In 2022, ICAMA of the Chinese Ministry of Agriculture and Rural Affairs granted a total of 720 pesticide registration certificates, of which one-third were registrations for export-only pesticides, growing at a rapid rate.

″Four firm development initiatives″ guiding the future of the pesticide industry and manufacturers

The pesticide industry is a knowledge-intensive and high-tech industry. After years of development, the Chinese pesticide industry has entered a critical period in terms of high-quality development. Where is the future? Yan highlighted the importance of the ″Four firm development initiatives″ which is a guide to the future development of the pesticide industry, whose details are as follows:

1. To firmly develop the pesticide industry as a real economy: Promoting the development of the pesticide industry is not only important because it is a real economy, but it is also a highly-beneficial economy. The world has about 8 billion people, with China accounting for 1.4 billion. Food security requires stable agricultural production and safeguards, which are inseparable from the high-quality development of pesticides.

2. To firmly develop the pesticide industry as a high-tech industry: The pesticide industry involves various high-tech elements, such as chemical science, biology, nanotechnology, and information applications, being highly technical and with high added value. Therefore, it is necessary to increase investments in science and technology, which is the only way to develop an efficient approach to achieving sustainable development.

3. To firmly and further develop the international market: As a major exporter of pesticides. China’s pesticide products have currently been exported to over 180 countries, accounting for over 50% of global trade. However, there is still room for further growth.

4. To firmly modernize the pesticide industry: The Chinese central government has proposed the industry’s basic modernization by 2035 and full-scale modernization by 2050. The pesticide industry is an important industry to the economy, and many pesticide enterprises, such as Lier Chemical, have established a good model of industrial modernization.

Also Read: Bayer, GenZero, and Shell collaborate to reduce methane emissions in rice cultivation

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)