Brazil biodiesel input demand, risks to rise

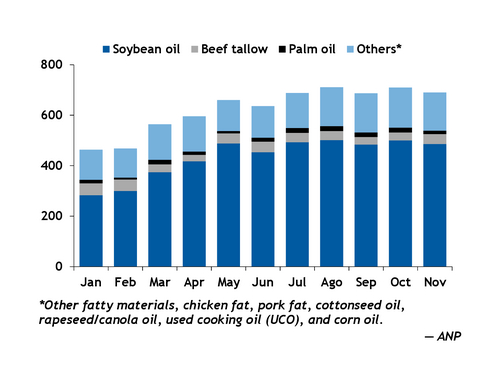

03 January 2024, Brazil: Brazil’s decision to accelerate the national biodiesel blending mandate will contribute to higher feedstock costs, as unfavorable weather threatens a slump in the soybean crop and as exports of beef tallow surge.

In mid-December, the national energy policy council CNPE increased the biodiesel mandate to 14pc starting in March, up from the current 12pc. According to the previous government schedule defined in March 2023, the blend was to increase to 13pc in 2024, adding to fuel costs but reducing emissions.

Neighboring Argentina is poised to recover its former share of the global soy export market after a period of drought. For 2023-24, 48mn metric tonnes (t) of soybeans are forecast to be harvested in Argentina, rebounding from 21.1mn t in the prior crop, according to the US Department of Agriculture (USDA).

Brazil’s soybean oil prices fell in 2023, influenced by five series of Argentina’s “soybean dollar” scheme, involving favorable exchange rates for soy exports in Argentina to boost currency reserves there. At the Brazilian port of Paranagua, prices of soyoil exports dropped by 31pc to $876/t fob in 2023,according to Argus data. Product delivered in Sao Paulo dropped by 22.5pc to R5,350/t ($1,091/t) cif. Those impacts may unwind as the new Argentinian president has moved quickly to stabilize the currency.

The Argus beef tallowassessment, which tracks the price of the second most used feedstock in the country, dipped last year by 13pc to R4,950/t on a cif Sao Paulo basis . Rising shipments to the US Gulf coast led to the product being traded at a premium to soyoil between March and May and in October.

Participants do not yet expecta shortage of biodiesel inputs. But investors are closely watching forecasts for dry weather in the country’s largest oilseed producing regions and for any cuts in harvest yield estimates.

In early December, national supply company Conab reduced its estimate for soybean production by 2.2mn metric tonnes to 162.2mn t for the 2023-24 period.

Even with the crop reduction, Conab expects the soybean harvest to be 3.6pc above the record 154.6mn t recorded in the prior cycle. But Brazilian investment bank Itau BBA expects the harvest will just 153mn t, or 7.2mn t below Conab’s predicton, with crop failure in west central Mato Grosso state possibly reaching 20pc and production below 40mn t.

One trading analyst estimates that the biodiesel mandate at 14pc will increase demand for soybean oil by 300,000t in 2024. The commodity differential at Paranagua compared to the Chicago Board of Trade (CBOT) strengthened in relation to the basis in Argentina’s Rosario region because of Brazil’s weather risk that may affect the soybean harvest in the world’s biggest producer. Participants are carefully monitoring the rainfall pattern in the center-west, the main soybean producing region in the country. Drought in Mato Grosso and Goias states delayed the planting of the oilseed and could harm productivity in the region.

Soybean crop planting in Brazil is 2.1 percentage points below last season at 94.6pc, according to Conab data. Weather conditions at the beginning of the year will be essential for crop growth and reduced rainfall may push up the price of vegetable oil in Chicago.

On the beef tallow side, the meatpacking and animal rendering sector have maintained estimates for stable 2024 production of 1.1mn-1.3mn t. Of this total, 35pc is usually directed to biodiesel, with the remainder divided between the hygiene, animal feed, and pet food sectors.

Brazil exported 198,340t of beef tallow in January-November 2023, up from 81,348t a year earlier, according to Brazil’s trade ministry data.

Limited heated tankingcapacity in ports prevents faster shipments, but scheduled investments in the ports of Porto Alegre in Rio Grande do Sul state, Paranagua in Parana, and Itaqui in Maranhao are expected to support exports in 2024.

Biodiesel producers in Brazil are starting to look at alternatives to eventually replace tallow with other inputs in periods when the product is at a premium to vegetable oils. Some options are cotton oil, used cooking oil (UCO), and mixes of other animal fats.

Biodiesel imports

Biodiesel imports remain on the industry’s radar screen, despite the 19 December decision of Brazil’s energy council CNPE to suspend biodiesel imports previously authorized by oil regulator ANP.

Brazil’s biodiesel congressional caucus FPBio is working to halt biodiesel imports, arguing that they have the potential to halt industry investments.

On 26 December, the ministry of mines and energy published anotice in Brazil’s official gazette that a working group with nine members will evaluate the impacts of potential imports and the new direct sales model launched in 2022. The objective is to defend domestic biodiesel production.

The working group to be established will have 180 days to submit to the CNPE a report on the effects of imports. This group must be formed within 30 days.

By Alexandre Melo

| Brazil’s biodiesel production | bn l |

| Year | |

| 2012 | 2.7 |

| 2013 | 2.9 |

| 2014 | 3.4 |

| 2015 | 3.9 |

| 2016 | 3.8 |

| 2017 | 4.1 |

| 2018 | 5.3 |

| 2019 | 5.9 |

| 2020 | 6.4 |

| 2021 | 6.8 |

| 2022 | 6.3 |

| 2023* | 7.3 |

| 2024* | 8.9 |

| 2025* | 10.1 |

| — ANP, Abiove | |

Biodiesel feedstocks in 2023 bn l

Also Read: Farmer must learn to market his produce: Vice President Dhankhar

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)