NACL Industries Ltd. announced its financial results for the Q1

05 August 2023, New Delhi: High inventories in most markets (particularly LATAM), a sharp decline in Al prices, and continued price pressures have impacted business

Key Standalone Financial Highlights

- Total income for the Quarter ended June 30, 2023, stood at Rs. 390.16 Cr, lower by 18% from the previous corresponding quarter.

- EBITDA negative for the quarter stood at Rs. 29.50 Cr compared to positive EBITDA of Rs. 36.34 Cr in the corresponding period of the previous year.

- Against a PAT of Rs. 15.13 Cr in 01 FY’ 23 the company’s loss for the Quarter ended June 30, 2023, stood at 36.60 Cr.

Key Strategic Highlights

- The Board of Directors approved the Company’s plan to expand its business portfolio with entry into Specialty Materials and Intermediates (including Fluorinated compounds), Specialty Nutrition, and Bioproducts, addressing Agriculture, Healthcare, Industrial, and other sectors.

- The Company envisages an investment of about Rs.1000 crores over the next three years for the said businesses including expansion of its existing Manufacturing and R&D facilities for captive as well as Custom Development and Contract Manufacturing opportunities.

- The Company has launched two new Maize Herbicide formulations “ROZZER” & “TEMBOGUARD” in Q1 FY’24. Additional launches are planned in the second quarter.

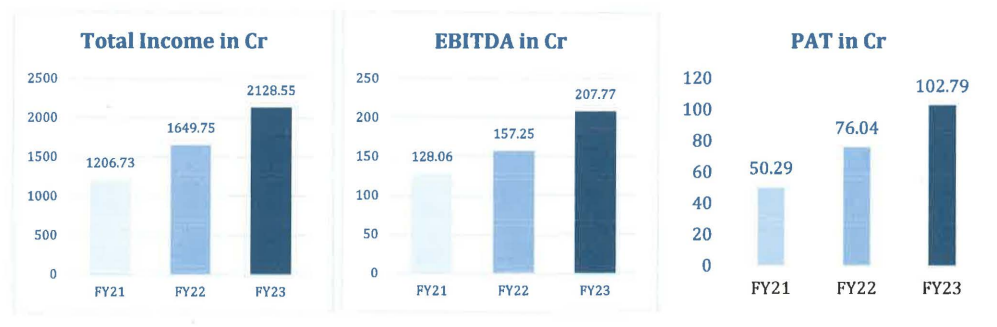

Annual Performance at a Glance

FY’22 Vs FY’23

Kev Updates on Ql 2023-24

- Exports contributed 29% of the total revenues during the first quarter of FY 2024. For the quarter ended 30.06.2023, there was a decrease of 42% over the last previous corresponding quarter. High inventories in most markets (particularly LATAM), a sharp decline in Al prices, and continued price pressures have impacted business. Additionally, the compulsion to liquidate high-value inventory, by several companies suggests a challenging outlook for the next quarter, with prospects likely to improve in Q3 FY’24.

- A delay in the onset of monsoons and their slow progress has delayed sowing this Kharif season. This combined with the price erosion in generic molecules presented a challenging environment. Despite these headwinds, the domestic retail business was able to perform above expectations and arrest the decrease in sales revenue to 16% over the previous corresponding quarter. Outlook for Q2 FY’24 remains positive, despite the challenges presented by floods in some areas and high inventory.

- The flagship technical plant in Srikakulam (AP) achieved its highest monthly production on April 23 reaching 1101 MT. Concurrently a new manufacturing line was successfully commissioned for a key “Intermediate” which will facilitate greater backward integration in the production of Active Ingredients. The formulation plant in Ethakota (AP) has started the in-house production of two formulations, with the potential for significant cost savings.

- The Company’s raw material supply remains largely stable, despite the price crash in a few products due to a lack of demand. The declining trend in the prices of raw materials is expected to continue for Q2 FY’24, and no disruptions in supply are anticipated.

- CRISIL has reaffirmed the company’s credit rating favorably for long-term & short-term bank facilities. For the long term – CRISIL Al Stable and short term – CRISIL A 1

- The long-term credit rating for Ms NACL Spec-Chem Limited a wholly owned subsidiary of the Company was upgraded to CR/SIL A-/Stab/e (Upgraded from ‘CR/SIL 888+/Stable’). It was also assigned CRISIL A2+ for short-term banking facilities.

- Mr. Santanu Mukherjee former MD of State Bank of Hyderabad, has been appointed as a NonExecutive and Independent Director on the Board of the Company with effect from July 27, 2023.

- The R&D team is working on improving the process for the synthesis of emerging Als and new agrochemical combinations (formulations) for overseas and Indian customers. As a result of these efforts over 100 registrations across the globe for several Active Ingredients and formulations are currently in progress.

- The company continues to invest in improving its sustainability benchmarks, with the recent commissioning of a vacuum distillation-based evaporation unit at Srikakulam, which will reduce effluent discharge by almost 90%.

Comments from Mr. Pavan Kumar, MD & CEO

Despite the efforts of our dedicated team, our revenues for Q1 FY24 were lower at Rs. 390.16 Cr vis-a-vis Rs. 478.27 Cr in Q1 FY23 due to adverse market conditions.

The crop protection industry has been facing significant headwinds in both the domestic as well as export markets, needing higher inventory provisioning amidst supply chain uncertainties and incessant price drops all coming together to create an unprecedented storm of market challenges.

In light of these challenges, NACL is actively implementing measures to strengthen its position and navigate these market conditions successfully carefully, and concertedly.

We are investing in R&D, optimizing supply chains and cost management processes to enhance efficiency and mitigate costs and risks. Despite the current setbacks, NACL remains committed to its long-term goals of capacity expansion, portfolio diversification, and customer centrality.

The company is confident that its strategic initiatives and customer-centricity will lead to improved financial performance in the upcoming quarters and thereafter.

Also Read: The rise of India’s population and the rise of the technologies to feed it

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)