Need to enhance customs duty to 30% on import of all Agrochemical formulations: CCFI

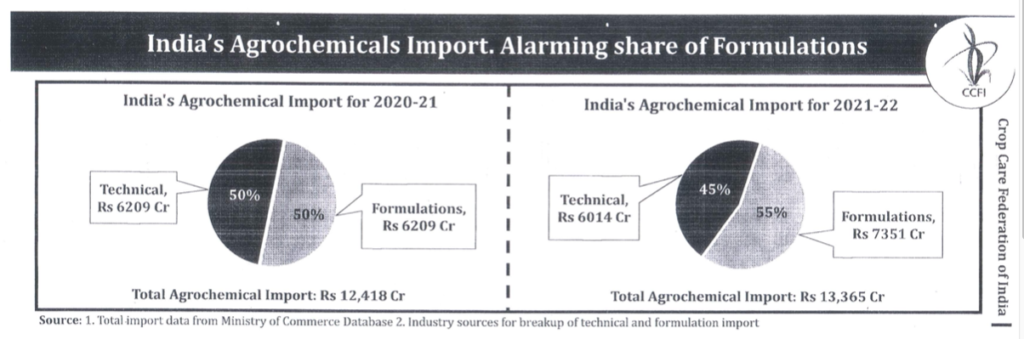

10 April 2023, New Delhi: The Crop Care Federation of India (CCFI) has expressed its major apprehension that despite being a trade surplus champion industry, there has been a major surge in agrochemical imports. There has been a 37% surge in the value of agrochemical imports in the last 2 years and a 50% increase if compared with the imports with 2019-20 as the base year.

The industry body CCFI submitted a representation to Mr/ Vivek Johri, IRS, Chairman, Central Board of Indirect Taxes & Customs (CBIC) Department of Revenue, Ministry of Finance on the imperative need to relook at the existing customs duty structure on import of agrochemicals.

Total Export and Import of Agrochemical in the last 5 years (2017-2022) including estimates for the year 2022-23

| Year | Agrochemical Exports from India(Rs. cr.) | Agrochemical Imports(Rs. cr.) |

| 2017-18 | 16,497 | 8,467 |

| 2018-19 | 22,126 | 9,267 |

| 2019-20 | 23,757 | 9,096 |

| 2020-21 | 26,513 | 12,418 |

| 2021-22 | 36,521 | 13,365 |

| Est: 2022-23 | 40,000 | 15,000 |

Mr. Harish Mehta, Senior Advisor at CCFI told Krishak Jagat, “Readymade formulations constitute almost 53% of the imports primarily by MNCs and traders for resale which needs to be stopped. Imported formulations generate no employment, there is no value addition and we are unable to quantify the correct quality profile resulting in a supply of substandard material. Indigenous manufacturers have the capacity and capability to produce most of these imported chemicals and save valuable foreign exchange in manufacturing intermediates, formulations, and technical at a lower cost ranging from 50-87% as compared with imports”.

Presently, import tariffs for formulations are at the same level as that of the Technical grade i.e. both at 10% (Reference Chapters 29 & 38 of Customs Tariff), resulting in no incentives for establishing manufacturing activities in India.

The association strongly feels that any change in customs duty on imports would not impact the farmer’s price as already the imported products are resold at exorbitant prices 2 to 2.5 times more expensive as compared to manufacturing them in India and used mainly for resale at profits upto 200% by the importers.

“CCFI members are crusaders of Government policy towards “Atmanirbhar Bharat” through Make in India. All the manufacturers have manufacturing plants with Research & Development facilities to make quality products meeting global specifications resulting in Indian members accounting for over 80% of the exports to 130 countries earning valuable foreign exchange” Mr. Mehta explained.

The association had already sent representations to modal Ministries that import of formulation without registering technical is not permissible in several developed countries like the USA, E.U., Brazil, Australia, Argentina, and even China.

On the other hand, a formulation manufactured in a foreign country is neither monitored nor the technical is checked for its quality. It is quite likely that a formulation may contain expired technical. This is a huge risk to human/ animal health, the environment, and product efficacy.

An RTI compilation by CCFI found that 97.3% of the samples tested during the last 5 years at accredited laboratories on all India basis met quality speculations. The Agriculture Minister Mr. Narender Tomar confirmed in Lok Sabha on 15th September 2020 (Parliamentary Question 390) that out of 3,38,282 samples drawn only 3,971 were not meeting specifications (1.171% substandard samples during the last 5 years).

CCFI has mentioned this surge in imports has resulted in severe injury to indigenous manufacturers which had to shut down. This has jeopardized the policy of Atmanirbhar.

Even during an inter-ministerial meeting with the Ministry of Chemicals & Fertilizers, it was reiterated that there should be a delta of at least 10% in custom duty on the import of formulation and technicals.

The association has always been pressing for the imposition of a 30% duty on the import of all ready-made formulations and a 20% custom duty on the import of all technical grades for the agrochemical industry as Indian manufacturers have the technical capability and the unutilized capacity ~ 35% to manufacture in India.

Also Read: US Biostimulants Summit 2023 from 12th July in Raleigh, North Carolina

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)