India has been producing excess quantity of sugar for last 10 years

08 March 2021, New Delhi: Indian Sugar Mills Association (ISMA) is the apex sugar organisation in India. It acts as the interface between the sugar industry and government. As a representative of the sugar industry, ISMA is committed to providing the right information about sugar to consumers. Abinash Verma, director-general, ISMA, shares evidence-based information around sugar, in an email interaction with Manjushree Naik. Excerpts:

India has been producing excess quantity of sugar. What is the position in the current season?

Yes, thanks to the surplus sugarcane production by the farmers continuously, India has been producing excess quantity of sugar for last 10 -11 years, higher than the domestic requirement of the country. As per the 2nd advance estimates of ISMA released on January 31, 2022, India is expected to produce 314.50 lakh tonne of sugar in the current season 2022-23 (October – September), as against estimated domestic consumption of 270 lakh tonne.

Do we export the excess quantity of sugar? Which are the countries to we export?

Yes, we have been exporting sugar during the last few years. During the last 2 seasons 2019-20 and 2020-21, the Indian sugar industry has exported about 131.5 lakh tonne from the surplus sugar. In the current sugar season, India has already contracted over 50 lakh tonne and has physically exported about 31.5 lakh tonne of sugar during October 2021 – January 2022, period. ISMA expects that in the current year India will export about 60 lakh tonne.

During the current year, India has so far exported about 25% of total exports to Bangladesh, followed by about 18% to Indonesia. However, during last year 2020-21, Indonesia was the main export destination of sugar from India followed by Afghanistan.

How is the export market with Brazil dominating the scene?

Due to adverse weather condition, sugar production in CS Brazil has been adversely affected in 2021-22 season (April – March), as the total production is expected to be around 32 million mt. The estimates of sugar production in Brazil in 2022-23 season starting from April 2022, is also around 33 to 34 million tonne which will still be around 4 – 5 million mt less than the usual.

It is also reported that start of next season in Brazil may be delayed by a fortnight and millers may maximise ethanol production at the start of season. Major importers of Brazilian sugar are China, Bangladesh, Indonesia, African countries and Saudi Arabia.

Further, due to lower production in Thailand in 2020-21 season, there was global deficit in 2020-21 season (October – September) and therefore demand for Indian sugar increased in global market and the millers availed this opportunity and exported about 7.2 million tonne of sugar last year.

Further, during 2021-22 season, a net global deficit has been estimated by different agencies which again gives us the opportunity for export sugar.

What about diversion to ethanol? How does it affect the sugar position in the country?

Government has been supporting the ethanol blending programme and has also allowed diversion of sugarcane juice and B heavy molasses into production of sugar, thereby diverting some surplus sugar in the process. As per supplies of ethanol made from these feed stocks, India had diverted about 28 lakh tonne of sugar in the last two seasons i.e. 2019-20 and 2020-21. In the current season, ISMA expects a diversion of 34 lakh tonne of sugar for production of ethanol.

Due to combined impact of sugar diversion into ethanol and export of sugar, we have been able to reduce opening stock of sugar from about 146 lakh tonne at the start of season 2019-20 to about 82 lakh tonne at the start of current 2021-22 season. ISMA expects opening stock to fall to a much comfortable level of around 66 lakh tonne for the 2022-23 season.

How has the National Bio-fuel Policy 2018 helped in this regard? What about the recent Union Budget?

National Policy on Biofuels, 2018, announced by Government on June 4, 2018, for promotion of blending of ethanol with petrol, provided manufacturing of ethanol from various feedstocks like B-Heavy molasses, sugarcane juice, damaged foodgrains like broken rice, maize, damaged food grains.

This resulted in conversion of different feedstocks into ethanol, which is being supplied to the OMCs for blending after announcement of National Policy on Biofuels 2018.

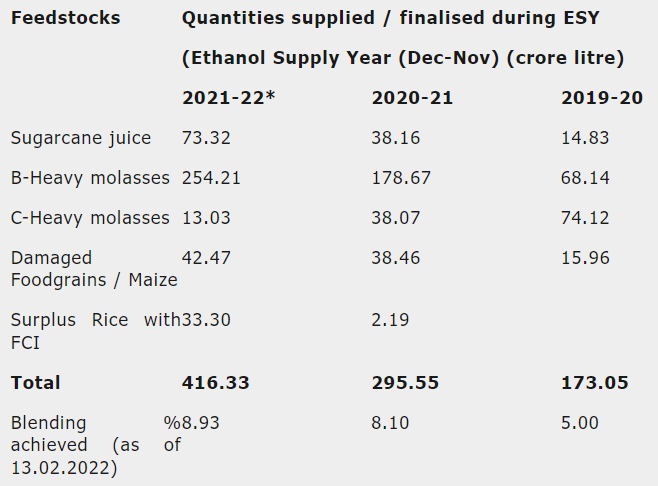

The following table would elaborate how ethanol from different feedstocks has picked up over the years:

*= figures for 2021-22 are finalised as of February 21, 2022

In her Budget Speech on February 1, 2022, Finance Minister had said that blending of fuel is a priority of Government and that to encourage the efforts for blending of fuel, unblended fuel shall attract an additional differential excise duty of Rs 2 per litre from October 1, 2022.

Accordingly, Department of Revenue, Ministry of Finance has issued Notification No. G.S.R. 90 (E) dated February 1, 2022, levying additional duty on unblended fuel at the rates prescribed therein, which will be effective from October 1, 2022. This will encourage sale of petrol blended with ethanol by all the oil companies retailing petrol.

How is the domestic consumption of sugar? Does production of ethanol affect sugar prices?

Domestic consumption of last 5 seasons given below indicates that it has increased at a constant pace with the exception of 2019-20 sugar season, which was due to pandemic. ISMA expects domestic consumption to grow by about 2% to 270 lakh tonne in the current season 2021-22:

2016-17 245.61 lakh tonne

2017-18 253.90 lakh tonne

2018-19 255 lakh tonne

2019-20 253 lakh tonne

2020-21 265.55 lakh tonne

2021-22 ( E ) 270 lakh tonne

Government had fixed Minimum Selling Price (MSP) of sugar almost 3 years back in Feb’2019 as Rs 31 per kg in a move to regulate sugar price and support sugar industry from falling sugar prices due to excess sugar stock and surplus production in the country. Since then, FRP of sugarcane has increased two times by Rs 15 per quintal thereby further increasing the cost of production of sugar. Average ex-mill sugar price hovered around Rs 32 per kg during 2019-20 and 2020-21 sugar seasons, even with higher ethanol production. Currently, average ex-mill sugar prices are hovering around Rs 31 – 33 per kg in different parts of the country. It therefore appears that sugar prices are not much affected by ethanol production only but is dependent on total sugar availability. Ethanol production from cane juice/B heavy molasses has helped reduce the surplus sugar from increasing further, which in turn has kept the ex-mill sugar prices in the range of Rs 31-33 per kilo in the last couple of years, and ensured that sugar prices don’t crash.

Till when do you estimate the excess sugar production to continue? What will happen in case of a shortage?

Under normal conditions, if there is no diversion into ethanol, India is expected to produce surplus sugar, higher than domestic consumption, in the range of 340 – 350 lakh tonne, unless disrupted by extreme weather conditions. However, after diversion into ethanol, it is expected that sugar production will remain around 300-310 lakh tonne in the next few years, still above the domestic requirement.

In case of a shortage, India can utilise the available sugar stocks and regulate diversion towards ethanol and exports accordingly. With enough sugarcane production, one does not expect any shortage of sugar in near future.

What about farmers’ arrears? Give details.

As per a press release by Government, total cane arrears on all India basis at the end of November, 2021 stood at around Rs 4,445 crore as compared to Rs 5,185 crore as on the corresponding period last year.

As per cane commissioner’s report from different States, cane price arrears as on February 15, 2022 are given below:

UP – Rs 5,200 crore

Maharashtra – Rs 1,520 crore

Bihar – Rs 124 crore

Uttarakhand – Rs 382 crore

What more can Government do for the sugar sector going forward?

Going forward, government may decide on the following points to make the sugar industry competitive:

- Rationalise sugarcane pricing policy and implement Revenue Sharing Formula (RSF), along with the Price Stablisation Fund. There is need to amend the sugarcane pricing policy in a manner which not only makes Indian sugar competitive in the international market but also makes Indian sugarcane pricing policy compliant and compatible with WTO rules. This kind of policy is a universal practice and is followed by almost all the sugar exporting countries.

- Immediate decision on increasing MSP of sugar to appropriate level of around Rs 36 – 37 per kg, with respect to the increase in FRP of sugarcane. This will protect the industry against any fall in sugar prices and also recover the cost of production of sugar. Further, this will also help the sugar mills to pay cane dues to farmers in time.

- Looking forward to government’s target of 20% ethanol blending with petrol, Government should come up with stable policies to ensure long term sustainability of the ethanol pricing policy and lay down the road map to achieve sale and use of 20% ethanol blended fuel.