How Can Farmland Capital by FBN Finance Help You Buy Land?

03 February 2022, San Carlos: A new alternative in the market is Farmland Capital by FBN® Finance. With Farmland Capital farmers can take a loan of up to 65% of bare land value (down payment of 35%) and then cover 49% of that down payment with Farmland Capital.

This means that farmers can buy land with as little as 17.85% down payment. Additionally, farmers do not have to pay any interest on the Farmland Capital investment, providing more flexibility with their cash flows to make the necessary investments in their business and to weather the ups and downs that are inherent in farming.

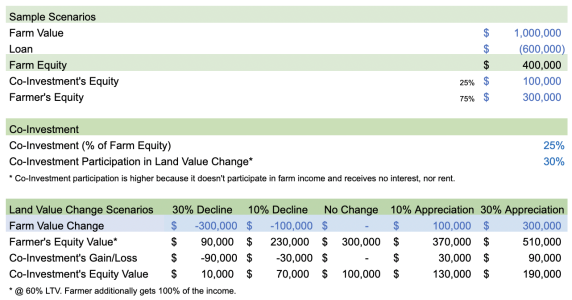

Farmland Capital is comparable to a farmer getting support or partnering with a relative. If the farmer gets a loan of $600,000 from the bank on a $1,000,000 farm, he still needs $400,000 to cover the down payment. If a relative covers 50% of that down payment, the farmer only needs $200,000 down to buy the farm. Both the farmer and the relative participate in 50% of the income and in 50% of the change in value (up or down). Let’s face it, there are a lot of farmers out there who don’t have a rich relative that wants to purchase land with them.

With Farmland Capital, the farmer gets 100% of the income (instead of 50%) and Farmland Capital gets 0% to give the farmer more flexibility with cash flows. In exchange for that, Farmland Capital gets ~60% of the change in farmland value over time (up or down).

If Farmland Capital invests less than 50% it also participates in less of the appreciation and depreciation. For instance, if $100,000 is invested the Farmland Capital partner would participate in ~30% of the change in value (up or down).

The goal of this program is for the farmer to buy out the co-investment at a future date. The agreement is for up to 10 years and the farmer can buy out the co-investment at any time based on the appraised value of the property. In the example of a Farmland Capital co-investment of $100,000 participating in 30% of the change in value:

- If the land goes up $100,000 in value (from $1,000,000 to $1,100,000) then Farmland Capital receives the $100,000 it invested + 30% of the change in value ($30,000) = $130,000.

- If the farm goes down $100,000 in value to $900,000, then Farmland Capital receives the $100,000 it invested – 30% of the change in value ($30,000) = $70,000. In this case Farmland Capital loses 30% of its investment.

Farmland Capital is structured as an option that participates in the appreciation or depreciation of the farm. The farmer is the owner of the property (Farmland Capital is not on the deed). The farmer makes all decisions and pays for all operating expenses, including property taxes, mortgage and insurance. Farmland Capital is junior to the mortgage loan so Farmland Capital can lose all its investment before the lender loses anything. Typically, the co-investment loses all its value even before the farmer. If the farm loses value Farmland Capital shares in that loss in value.

FBN is bringing this new product to market to connect farmers looking to expand their operation with investors interested in the protection that farmland provides relative to investments in other markets. These investors value investing alongside good farmers that are aligned on farm value preservation and have majority direct ownership.

Partnering with Farmland Capital makes buying land less capital intensive and as a result farmers can buy more land earlier. The contract is structured so that typically a farmer can buy out the investment within 3-9 years with the equity they have built via:

- Land appreciation plus

- Equity built via land loan payments plus

- Savings generated from farm income

Farmland Capital gives growing Farmers a path to ownership while maintaining full control of the land and their destiny.

Ultimately, FBN sees Farmland Capital as a way to level the playing field in the ever consolidating world of agriculture, allowing farmers to compete with institutional investors and hedge funds for land, keeping US Farmland farmer owned and controlled.