Farmers Edge Reports Second Quarter 2022 Results

15 August 2022, Canada: Farmers Edge Inc., a pure-play digital agriculture company reports its financial results for the three months and six months ended June 30, 2022. All amounts are expressed in Canadian dollars. Certain metrics are non-GAAP and other financial measures or key performance indicators. See “Key Performance Indicators and Non-GAAP and Other Financial Measures” below.

● New Digital Agronomy acres added for the three months and the six months ended June 30, 2022 were 1.3 million and 2.9 million acres, respectively, including 0.6 million new Progressive Grower Program (“PGP”) acres in Q2 2022 (YTD – 1.5 million PGP acres).

● Subscribed acres were 15.3 million which was lower than at March 31, 2022 due to the release of PGP acres not converted and paid acres churn. Additionally, we reduced the carbon offset revenue in ARR by $4.0 million due to pricing uncertainty. This resulted in ARR of $49.0 million at June 30, 2022.

● A decision was taken to pause the Progressive Grower Program (“PGP”), effective July 8th 2022 which will reduce cash burn rate. We are no longer signing up customers on free acres and the PGP 2021 conversion rate to paid acres is expected to be approximately 30%.

Business Highlights

“Our technology is our core strength and we strive to lead the industry by offering best-in-class digital solutions to our customers and our partners, “said Vibhore Arora, Chief Executive Officer of Farmers Edge. “Our current focus is to improve our execution and implement cost-saving initiatives to lower our operating costs and reduce our cash burn.”

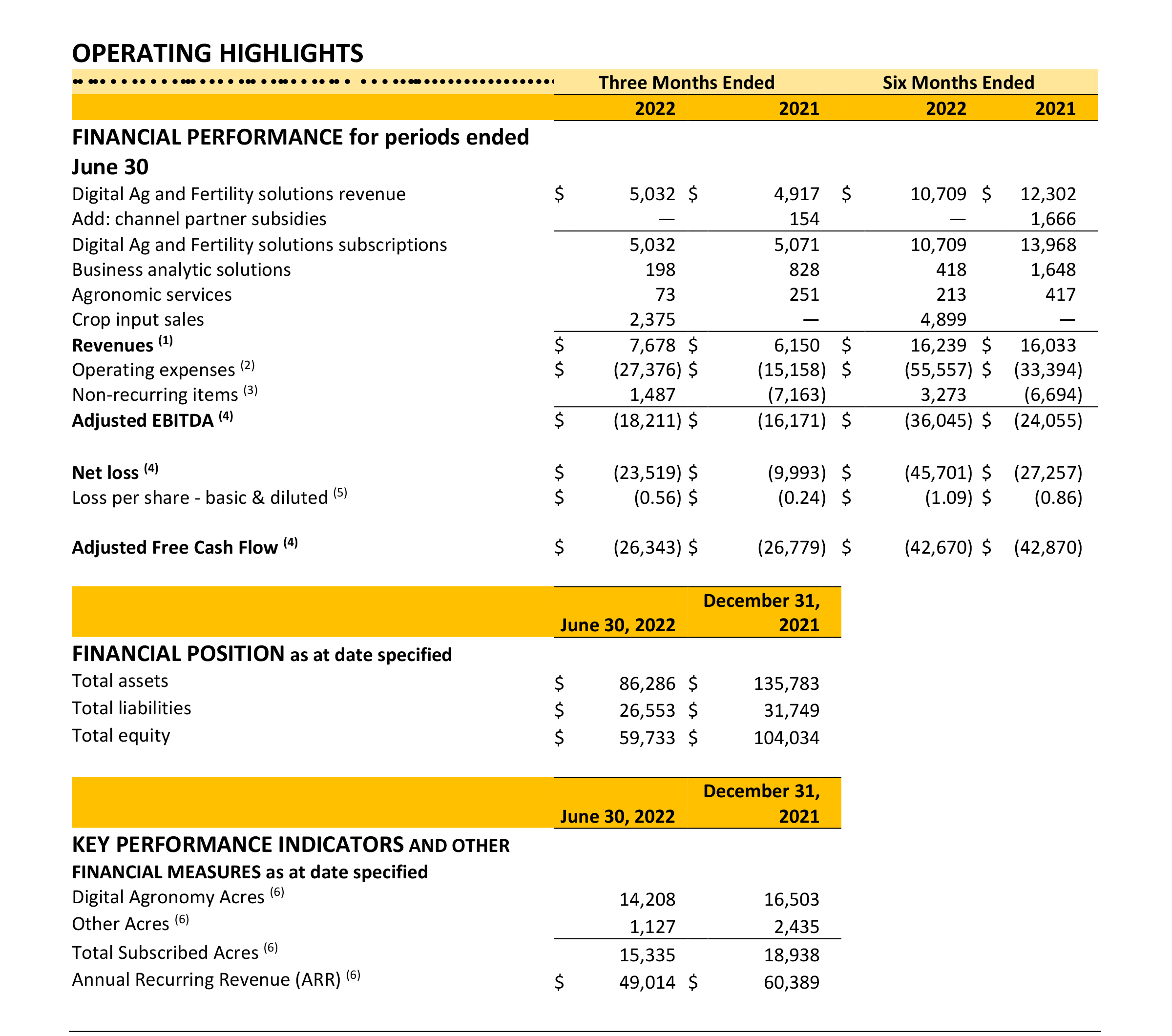

(1) Revenues include $0.2 million and $1.7 million subsidies revenue related to commercial partner agreements for the three months and six months ended June 30, 2021, respectively. There was no similar item in the three months and six months ended June 30, 2022.

(2) Operating Expenses include Cost of revenue, Data and technology infrastructure expenses, Selling and marketing expenses, Product research and development expenses, and General and administrative expenses including restructuring expenses and non-recurring legal fees as set out on the Company’s Statements of Operations and Comprehensive Loss in its Financial Statements.

(3) Non-recurring items include restructuring expenses of $0.4 million and legal and consulting fees of $1.1 million in Q2 2022 compared to $1.0 million in Q2 2021 related to legal and consulting fees. Non-recurring items also include restructuring expenses of $1.2 million and legal fees of $2.1 million in Q2 YTD 2022 compared to $0.5 million related to costs incurred to become a public company and legal fees of $1.0 million in Q2 YTD 2021. Satellite imagery settlement gain of $8.2 million was included in Q2 2021 and the YTD 2021 numbers.

(4) Adjusted EBITDA and Adjusted Free Cash Flow are non-GAAP financial measures used throughout this MD&A. See “Key Performance Indicators and Non-GAAP and Other Financial Measures” for more information on each non-GAAP financial measure. A quantitative reconciliation of Adjusted EBITDA to Net loss and Free Cash Flow, the most directly comparable IFRS financial measures are disclosed in our financial statements to which Adjusted EBITDA and Adjusted Free Cash Flow relates, is in the “Results of Operations” section of this MD&A.

(5) Dilutive securities have been excluded from the calculation of diluted loss per share because including them would be anti-dilutive. The loss per share – basic and diluted for the periods ended June 30, 2021 and 2022 have been retrospectively adjusted to reflect the consolidation of common shares on a 7:1 basis, which occurred at the time of the IPO.

(6) Digital Agronomy Acres, Other Acres, Total Subscribed Acres and ARR are supplementary financial measures used throughout this MD&A. See “Key Performance Indicators and Non-GAAP and Other Financial Measures” for more information on each supplementary financial measure. These numbers are unaudited.

● Revenues for the three months and the six months ended June 30, 2022 (after adjusting for partner subsidies) were up $1.7 million and $1.9M, respectively. The company had new crop input e-commerce sales in 2022. Digital Ag and Fertility solution subscriptions revenue was flat in Q2 2022 compared to Q2 2021. Lower fertility revenue in Q1 2022 of $1.0 million was due to a higher soil test completion rate in Q4 2021. New paid acres revenue was offset by the loss in paid acres from the discontinuances in 2021 and 2022. There were also no carbon sales in 2022.

● The Adjusted EBITDA loss for the second quarter of 2022 was $18.2 million (2021 – $16.2 million), $36.0 million (2021 -$24.1 million) for the six months ended June 30, 2022, which reflects higher inflation and costs in sales and marketing, people, CommoditAg operating expenses and other public company costs.

● Adjusted Free Cash Flow deficiency was $26.3 million (2021 – deficiency of $26.8 million) in the second quarter of 2022, and a deficiency of $42.7 million (2021- deficiency of $42.9 million) for six months ended June 30, 2022.

● The Net loss was $23.5 million (2021 -$10.0 million loss) for the second quarter of 2022 and $45.7 million (2021 – $27.3 million) for six months ended June 30, 2022 with most of this difference due to higher costs, lower government grant income and one-time non-recurring expenses.

● On July 15, 2022, the company closed the previously-announced C$75 million secured credit facility with Fairfax (the “Facility”).

Conference Call Notice

Farmers Edge will hold a live audio webcast at 8:30 a.m. Eastern Time on Monday August 15, 2022 to discuss the Company’s financial results and business highlights. All interested parties are invited to listen to the live audio webcast at https://www.gowebcasting.com/11998. Following the event, a replay of the webcast will be available on the Farmers Edge Investor Relations website.

Key Performance Indicators & Non-GAAP and Other Financial Measures

This press release makes reference to certain non-GAAP and other financial measures and key performance indicators (“KPIs”). These measures are not recognized measures under IFRS and do not have a standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Rather, these measures are provided as additional information to complement those IFRS measures by providing further understanding of our results of operations from management’s perspective. Accordingly, these measures should not be considered in isolation nor as a substitute for analysis of our financial information reported under IFRS. We make reference to the following non-GAAP measures: “Adjusted EBITDA” and “Free Cash Flow”. This press release also makes reference to “Annual Recurring Revenue” or “ARR” and “Digital Agronomy Acres”, “Other Acres” and “Subscribed Acres”, which are operating metrics used in our industry. These non-GAAP measures and KPIs are used to provide investors with supplemental measures of our operating performance and thus highlight trends in our core business that may not otherwise be apparent when relying solely on IFRS measures. We also believe that securities analysts, investors and other interested parties frequently use non-GAAP measures in the evaluation of issuers. Our management also uses non-GAAP measures and KPIs in order to facilitate operating performance comparisons from period to period, to prepare annual operating budgets and forecasts and to determine components of management compensation.

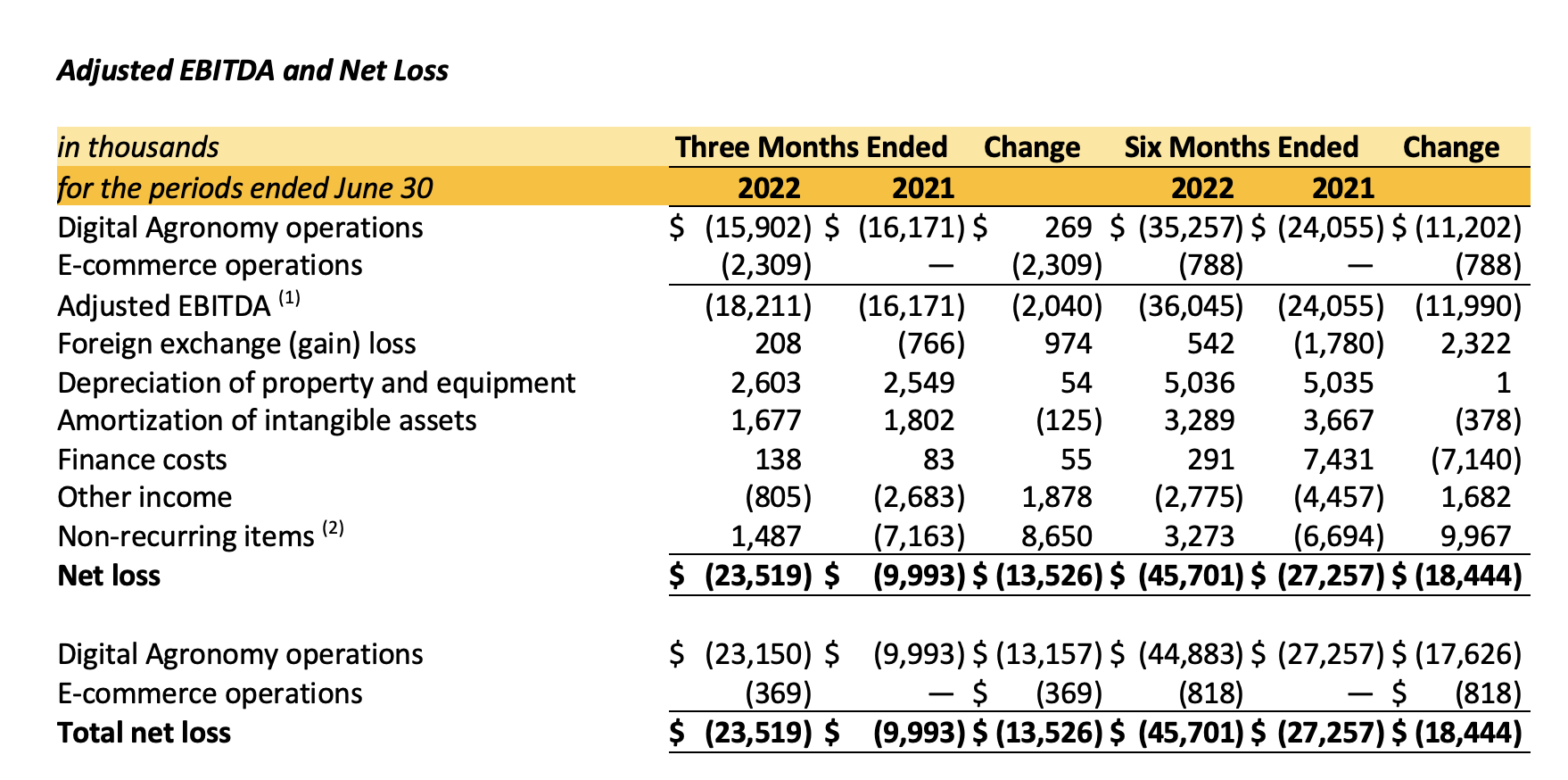

Adjusted EBITDA is the net loss before income tax expense, other income, finance costs, foreign exchange (gain) loss, depreciation and amortization after adjusting for the effects of any unusual non-recurring items. Adjusted EBITDA is a non-GAAP financial measure and its more directly comparable financial measure that is disclosed in our financial statements is net loss. The Company’s management and Board use this measure to evaluate consolidated operating results. In addition, this measure is used to make operating decisions as it is an indicator of the performance of the business and how much cash is being used by the Company and assists in determining resource allocation decisions. This measure may not be comparable to similar measures presented by other companies. See reconciliation under “Results from Operations”.

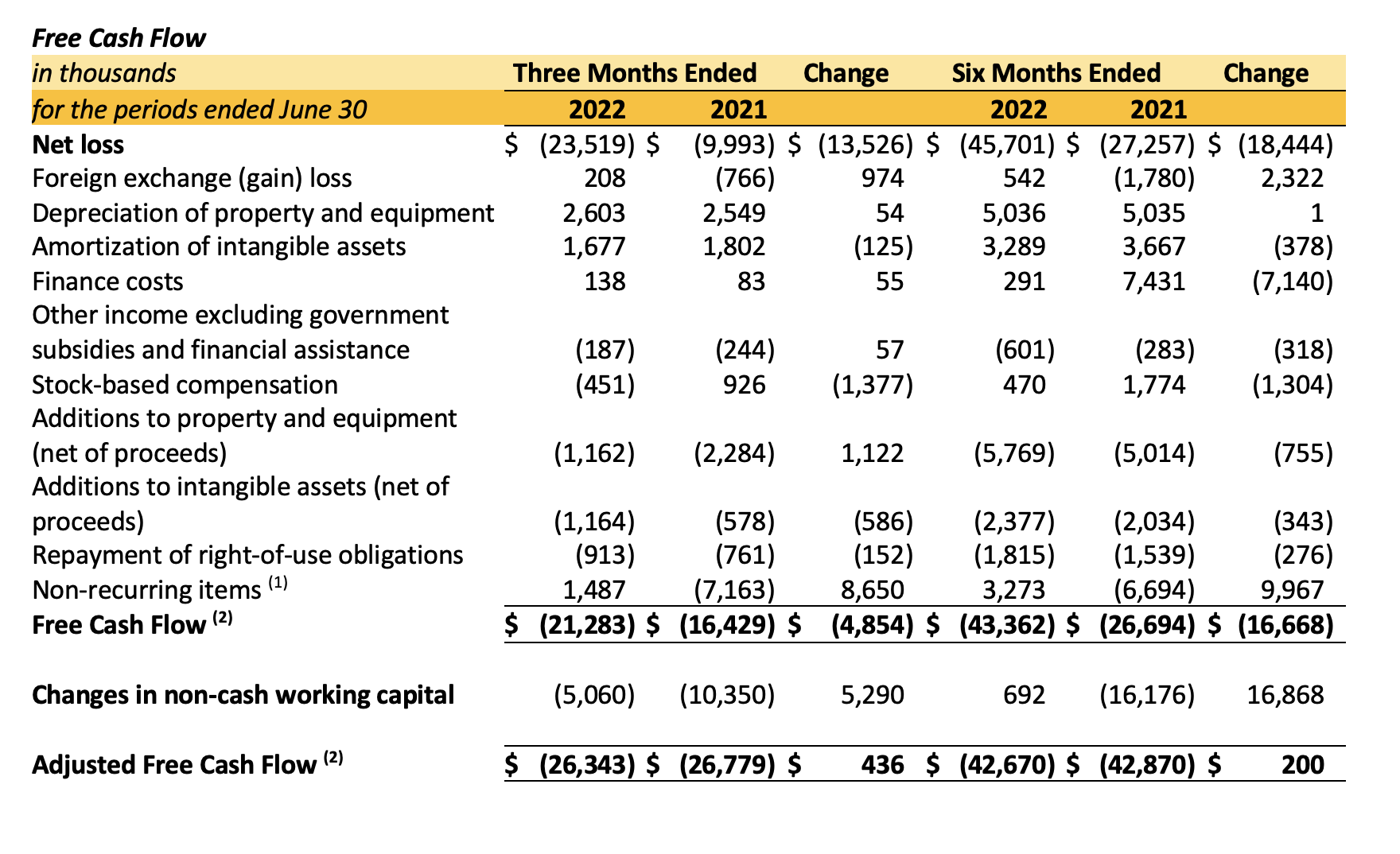

Free Cash Flow is net loss, adjusted for other income excluding government subsidies and financial assistance, finance costs, foreign exchange (gain) loss, depreciation and amortization as set out in the Company’s consolidated statement of operations and comprehensive loss in the financial statements, stock-based compensation, net additions to property and equipment and intangible assets, repayment of right‑of‑use obligations, and any unusual non‑recurring items. Free Cash Flow is a non-GAAP financial measure and its more directly comparable financial measure that is disclosed in our financial statements is net loss during the period. The Company’s management and Board use this measure to assess the availability of the Company’s cash. See reconciliation in “Results of Operations”.

Adjusted Free Cash Flow is net loss, adjusted for other income excluding government subsidies and financial assistance, finance costs, foreign exchange (gain) loss, depreciation and amortization as set out in the Company’s consolidated statement of operations and comprehensive loss in the financial statements, stock-based compensation, net additions to property and equipment and intangible assets, repayment of right‑of‑use obligations, any unusual non‑recurring items and changes in non-cash working capital. Free Cash Flow is a non-GAAP financial measure and its more directly comparable financial measure that is disclosed in our financial statements is net loss during the period. The Company’s management and Board use this measure to assess the availability of the Company’s cash. See reconciliation in “Results of Operations”.

Adjusted Free Cash Flow is useful as a performance measure to analyze the cash used in operations before the seasonal impact of changes in working capital items or other unusual items.

(1) Adjusted EBITDA is a non-GAAP financial measure. See “Key Performance Indicators and Non-GAAP and Other Financial Measures” for more information on each non-GAAP financial measure. This table provides a quantitative reconciliation of Adjusted EBITDA to Net loss, the most directly comparable IFRS financial measure disclosed in our financial statements to which Adjusted EBITDA relates.

(2) Non-recurring items include restructuring expenses of $0.4 million and legal and consulting fees of $1.1 million in Q2 2022 compared to $1.0 million in Q2 2021 related to legal and consulting fees. As well, non-recurring items include restructuring expenses of $1.2 million and legal fees of $2.1 million in Q2 YTD 2022 compared to $0.5 million related to costs incurred to become a public company and legal fees of $1.0 million in Q2 YTD 2021. Satellite imagery settlement gain of $8.2 million was included in Q2 2021 and the YTD 2021 numbers.

(1) Non-recurring items include restructuring expenses of $0.4 million and legal and consulting fees of $1.1 million in Q2 2022 compared to $1.0 million in Q2 2021 related to legal and consulting fees. As well, non-recurring items include restructuring expenses of $1.2 million and legal fees of $2.1 million in Q2 YTD 2022 compared to $0.5 million related to costs incurred to become a public company and legal fees of $1.0 million in Q2 YTD 2021. Satellite imagery settlement gain of $8.2 million was included in Q2 2021 and the YTD 2021 numbers.

(2) Adjusted Free Cash Flow is a non-GAAP financial measure. See “Key Performance Indicators and Non -GAAP and Other Financial Measures”. This table provides a quantitative reconciliation of Adjusted Free Cash Flow to net loss during the period, the most directly comparable IFRS financial measure disclosed in our financial statements to which Adjusted Free Cash Flow relates.