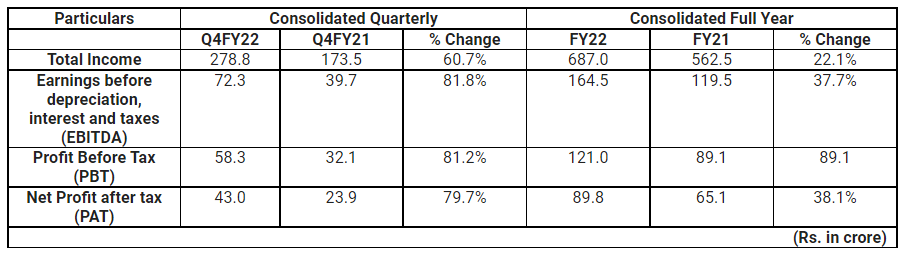

Astec LifeSciences Limited Q4 FY22 results: Consolidated total income increased by 60.7% Year-on-Year, PAT by 79.7%

10 May 2022, Mumbai: Astec LifeSciences Limited (“Astec”) has today announced its financial results for the fourth quarter and financial year ended March 31, 2022.

Q4 FY22 consolidated total income increased by 60.7% year-on-year, EBITDA grew by 81.8% year-on-year, EBITDA margin improved by 345bps and Profit after tax grew by 79.7% year-on-year

FY22 consolidated total income increased by 22.1% year-on-year, EBITDA grew by 37.7% year-on-year, EBITDA margin improved by 279bps and Profit after tax grew by 38.1% year-on-year.

Commenting on the performance, Nadir B Godrej, Chairman, Astec LifeSciences Limited, said: We delivered our best quarterly performance till date with highest ever total income of Rs. 278.8 Crore and Profit after tax (PAT) of Rs. 43.0 Crore in Q4 FY22. Total income grew by 60.7% year-on-year while PAT grew by 79.7% year-on-year. The remarkable growth was supported by strong realizations in export markets and healthy volume growth in contract manufacturing (CMO). In terms of full year results, it was another year of stellar performance, with growth of 22.1% in total income and 38.1% in profit after tax, year-on-year, respectively. Robust topline performance accompanied by improvement in profitability was driven by higher realizations in exports, favourable product mix, and operational efficiencies.

FY22 BUSINESS HIGHLIGHTS

The robust growth in FY22 was driven by a combination of higher exports realization, favourable product mix and operational efficiencies. Geographically, exports were the main driver growing by 44.4% year-on-year while in terms of segment, growth was led by enterprise sales. The share of exports increased to 57.7% of the total income from 48.7% in the previous year. Domestic sale was 42.3% of total income and grew by 0.5% year-on-year. Astec also achieved healthy gross margin expansion to the tune of 447 bps to reach 42.8% in FY22 vs. 38.4% in FY21. The higher realizations were aided by benefits from investment in backward integration.

Also Read: nurture.farm announces exclusive partnership with Dubai based agrochemical company Agfarm