ICL Reports Record Third Quarter 2022 Results

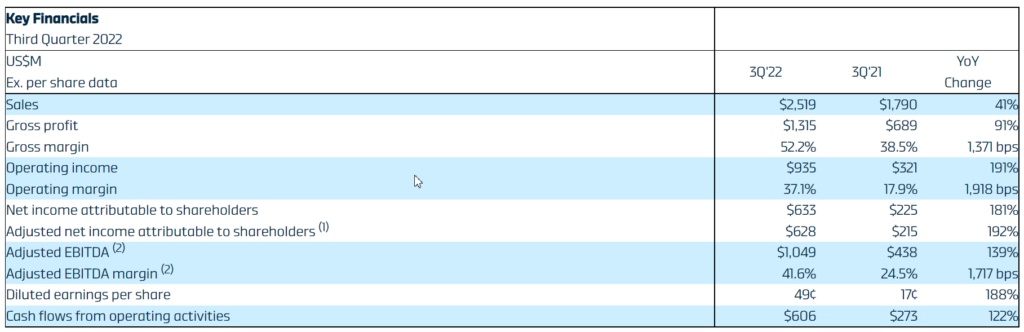

10 November 2022, Israel: ICL (NYSE: ICL) (TASE: ICL) , a leading global specialty minerals company, today reported its financial results for the third quarter ended September 30, 2022. Consolidated sales of $2,519 million were up 41% year-over-year versus $1,790 million. Operating income of $935 million was up 191% versus $321 million, while adjusted operating income of $928 million was up 195% versus $315 million. Net income of $633 million was up 181%, while adjusted net income of $628 million was up 192%. Adjusted EBITDA of $1,049 million was up 139% versus $438 million. Adjusted EBITDA margin of 41.6% was up versus 24.5%. Earnings per share of $0.49 were up 188% versus $0.17.

Once again, ICL’s focus on long-term specialties solutions benefitted the company, as did additional upside from commodity prices, which began to ease following record-setting rates in the first half of the year.

“ICL delivered another quarter of record results, with record third quarter and year-to-date sales, operating income, EBITDA, operating cash flow and net profit, as well as a new production record at our Dead Sea site and year-to-date records for free cash flow and EPS. All three of our specialties businesses delivered record third quarter results, even with shifts in demand and continued global supply chain challenges,” said Raviv Zoller, president and CEO of ICL. “Our third quarter results reinforce our recent investor day message, which stressed our commitment to growing our leadership position across our differentiated businesses, as these represent significant long-term opportunities for ICL to deliver sustainable shareholder value.”

ICL expects to be at the upper end of its previously issued guidance range, which called for full year adjusted EBITDA of between $3,800 million to $4,000 million, with between $1,500 million to $1,600 million of this amount estimated to come from the company’s specialties focused businesses. (1a)

(1) Adjusted net income attributed to shareholders is a non-GAAP financial measure. Please refer to the adjustments table and the disclaimer below. (2) Adjusted EBITDA is a non-GAAP financial measure. Commencing in 2022, the company’s adjusted EBITDA definition was updated, see consolidated EBITDA table and disclaimer below.

Industrial Products

Third quarter 2022

- Record sales of $437 million were up $50 million or 13%.

- Record operating income of $154 million was up $49 million or 47%.

- Record EBITDA of $170 million was up $49 million or 40%.

- Maintained pricing, even as end-markets remained mixed and as raw materials prices remained elevated.

Highlights

- Elemental bromine: Sales were in-line with the third quarter of 2021, on lower volumes and with moderating bromine prices.

- Bromine-based flame retardants: Sales were slightly higher year-over-year, as pricing remained intact, however, electronics end-market demand remained soft.

- Phosphorus-based flame retardants: Sales were lower year-over-year, due to reduced construction activity and as Chinese supply remained in the market, however, pricing was preserved.

- Clear brine fluids: Sales increased year-over-year on higher prices, as the oil and gas industry maintained its positive momentum.

- Specialty minerals: Continued strong demand, with higher sales of magnesium chloride and potassium chloride for use in industrial applications.

Potash

Third quarter 2022

- Sales of $854 million were up $454 million or 114%.

- Operating income of $496 million was up $412 million – a significant increase.

- EBITDA of $537 million was up $416 million, also a significant increase.

- Grain Price Index increased year-over-year, with corn up 28.5%, rice up 23.5%, soybeans up 6.1% and wheat up 37.6%.

- Average potash realized price per ton of $652 was up 106% year-over-year, as prices remained elevated, due to continued uncertainty in global fertilizer markets.

Highlights

- ICL Dead Sea

– Production increased year-over-year, as the site set new production records and continued to benefit from operational improvements and efficiencies. - ICL Iberia

– Production improvements continued to advance at the Cabanasses mine, with performance improvement measures on-track. - Metal Magnesium

– Higher prices contributed to record quarterly sales and profit.

Phosphate Solutions

Third quarter 2022

- Record sales of $766 million were up $167 million or 28%.

– Phosphate specialties: Record sales of $455 million, up $110 million or 32%.

– Phosphate commodities: Record sales of $311 million, up $57 million or 22%. - Record operating income of $193 million was up $105 million or 119%.

- Record EBITDA of $239 million was up $98 million or 70%.

– Phosphate specialties: Record EBITDA of $111 million, up $60 million or 118%.

– Phosphate commodities: Record EBITDA of $128 million, up $38 million or 42%. - The global phosphates market remained imbalanced, with demand outstripping supply in most regions and continued raw material and logistical challenges.

- Demand continued to grow for the specialty raw materials used for energy storage solutions.

Highlights

- Phosphate salts: Sales increased, with higher prices and strong demand for food across all regions, while industrial applications remained resilient in the U.S.

- White phosphoric acid: Sales benefitted from continued higher prices in the Americas, which helped offset increases in raw material costs and some softness in Europe.

- Dairy protein: Sales increased significantly year-over-year, driven by strong demand for specialty milk powders.

- Phosphate fertilizers: Sales were in-line with the prior year, as Russian exports impacted market prices.

Growing Solutions

Third quarter 2022

- Record sales of $629 million were up $125 million or 25%.

- Record operating income of $112 million was up $60 million or 115%.

- Record EBITDA of $127 million was up $60 million or 90%.

- Higher prices for premium products drove year-over-year improvement, while prices for raw materials and other cost inputs remained elevated.

Highlights

- Specialty fertilizers: Higher sales were driven by higher prices across most regions.

- Turf and ornamental: Results slightly ahead of the prior year, as both turf and landscape and ornamental horticulture markets were positive.

- Brazil: Sales increased year-over-year, due to specialties focus product range and related premium pricing, as region entered peak season.

- Polysulphate: Sales continued to improve on higher prices and volumes and as production increased nearly 10% year-over-year.

Financial Items

Financing Expenses

Net financing expenses for the third quarter of 2022 were $24 million, down versus $34 million in the corresponding quarter of last year.

Tax Expenses

Tax expenses in the third quarter of 2022 were $276 million, reflecting an effective tax rate of 30%, compared to $45 million in the corresponding quarter of last year, reflecting an effective tax rate of 16%. The relatively high tax rate for this quarter is the result of tax expenses related to the surplus profit levy, partially offset by the favorable impact of the devaluation of the Israeli shekel against the U.S. dollar.

Liquidity and Capital Resources

ICL has long-term credit facilities of $1,100 million, of which $325 million were utilized as of September 30, 2022.

Outstanding Net Debt

As of September 30, 2022, ICL’s net financial liabilities amounted to $2,181 million, a decrease of $268 million compared to December 31, 2021.

Dividend Distribution

In connection with ICL’s third quarter 2022 results, the Board of Directors declared a dividend of 24.35 cents per share, or approximately $314 million, up versus 8.37 cents per share, or approximately $107 million, in the third quarter of last year. The dividend will be payable on December 14, 2022, to shareholders of record as of November 30, 2022.

(For Latest Agriculture News & Updates, follow Krishak Jagat on Google News)