Godrej Agrovet Limited reports consolidated total income of Rs. 2,003 crore for first quarter of 2021

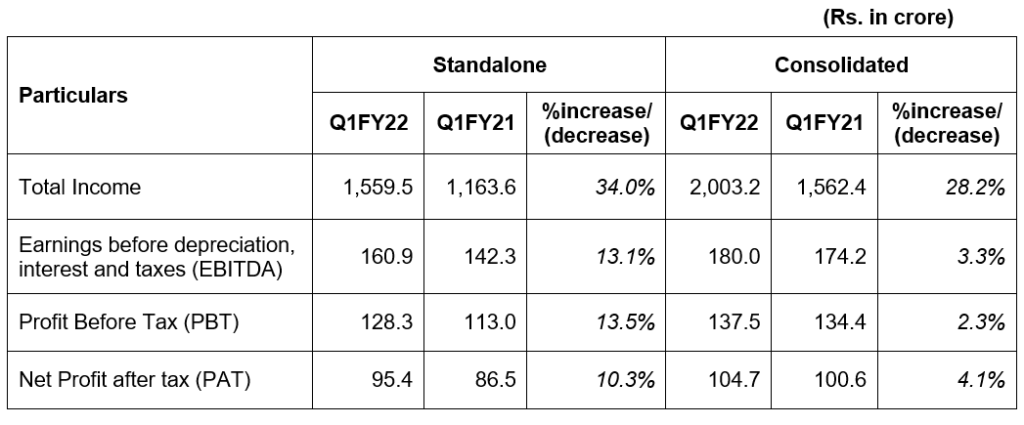

- For the first quarter ended June 30, 2021, company reported standalone total income of Rs.1,560 crore which is an increase of 34.0% year-on-year. Standalone profit before tax was Rs.128 crore which is an increase of 13.5% year-on-year

- For the first quarter ended June 30, 2021, company reported consolidated total income of Rs.2,003 crore which is an increase of 28.2% year-on-year. Consolidated profit before tax was Rs.137 crore which is an increase of 2.3% year-on-year

12 August 2021, New Delhi: Highlights of financial performance (Q1FY22)

Consolidated PBT includes profit from share of associate/JVs

Managing Directors Comments

Commenting on the performance of the Q1FY21, Mr. B. S. Yadav, Managing Director, Godrej Agrovet Limited, said:

I am pleased to share with you the financials of Godrej Agrovet Limited for the quarter ended June 30, 2021. Consolidated total income was Rs.2,003 crore, registering a growth of 28.2% year-on-year. Consolidated profit before tax was Rs.137 crore, registering a growth of 2.3% year-on-year.

It was one of the best quarterly performance for the animal feed business with segment results growing by 32.5%, supported by volume growth and R&D benefits realization. Vegetable oil benefitted from higher oil prices and posted segment results of Rs.32.6 crore which was a 4X increase year-on-year. Standalone crop protection business also registered a modest growth of 5.9% in segment results. However, Astec LifeSciences EBITDA declined by 13.7% due to lower export sales and higher input cost inflation. In the food businesses, demand recovery seen in the previous quarter was impacted by micro-lockdowns in the current quarter. Profitability was further impacted by low end-product price. Our dairy subsidiary, Creamline dairy registered an EBITDA loss of Rs.3.1 crore due to increase in the procurement costs. Our poultry and poultry products business faced a challenging quarter with low end-product prices on one hand and high input costs on the other hand. As a result, Godrej Tyson Foods Limited, registered a marginal loss at the EBITDA level.

The second wave of COVID-19 has significantly impacted economic recovery seen in the preceding quarter, especially in rural India which had a much stricter lockdown. Further, after a good start to the south-west monsoon, there was a long gap that resulted in lower Kharif sowing. However, recovery has gained pace from July-21 onwards with macro-economic indicators improving m-o-m and rainfall in July-21 covering most parts of India. We expect recovery to be faster in the second half of the year, as vaccination percentage increases leading to the normalization of business activities.

At Godrej Agrovet we are ensuring business continuity along with employee safety. We are conducting a nation-wide vaccination drive for company employees & families, contractual workforce, trade partners. Nearly 88% of our employees have received the first dose and we will cover the entire employee base shortly. During these tough times we are also committed to serve society. Our CSR strategy has been pivoted to strengthen the public healthcare system in order to address the challenges faced by rural communities. We provided medical material and health equipments at various locations and helped the Government effort towards combating the pandemic.

Segment-wise business highlights

Animal Feed

- Demand up-tick in feed categories i.e. cattle, broiler and layer led to strong volume growth. This coupled with price hikes taken during the quarter resulted in revenue growth of 33.9% YoY in Q1FY22

- Segment results grew by 32.5% YoY despite high increase in key commodity prices. Realisation of R&D benefits and strategic raw material stocking supported profitability levels

- However, aqua feed business was adversely impacted by limited ability to pass on the raw material price increase in shrimp feed

Vegetable Oil

- During the current quarter, segment revenue grew by 83.5% year-on-year due to increase in Crude palm oil and Palm Kernel oil prices

- Segment results increased to Rs.32.6 crore in Q1FY22 from Rs.6.5 crore in Q1FY21 supported by strong segment revenue growth

Crop Protection (standalone)

- In Q1FY22, segment revenues and results grew by 15.4% and 5.9%, respectively, year-on-year driven by higher sale of in-house products over the previous year.

- Sales could have been higher, but good and early start of south-west monsoon was followed by a long gap of 25-30 days, which affected the sowing of major crops and thereby the demand for agrochemicals in June -21

Astec:

- Revenue growth of 14.9% is driven by domestic business as exports have declined in Q1FY22. Prices of key products declined in the international markets, which caused sales to be lower despite increase in volumes.

- EBITDA is also impacted by raw material costs inflation which restricted increase in gross profit. Further, fixed overheads have increased due to normalization of business activity over the previous year.

Dairy

- Sales grew by 12.7% driven by volume growth across product categories, albeit on a low base of Q1FY21. However, the demand for milk and milk products was impacted by the micro lockdowns in southern states in Q1FY22

- EBITDA has been impacted by increase in procurement costs and other fixed overheads. Companies in southern India have not taken price hikes to pass on the increase in procurement costs.

Godrej Tyson Foods Limited

- Company recorded revenues of Rs.177.6 crore in Q1FY22, a growth of 7.3%. However, at the EBITDA level company reported a marginal loss.

- Low end-product prices on one hand and high input costs on other hand impacted profitability levels.

ACI Godrej Agrovet Private Limited, Bangladesh

- The joint venture reported revenues of Rs.378.2 crore for the current quarter compared to revenues of Rs.309.4 crore for the previous period registering a strong growth of 22.2%.